India Form No. 3848 1999-2026 free printable template

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

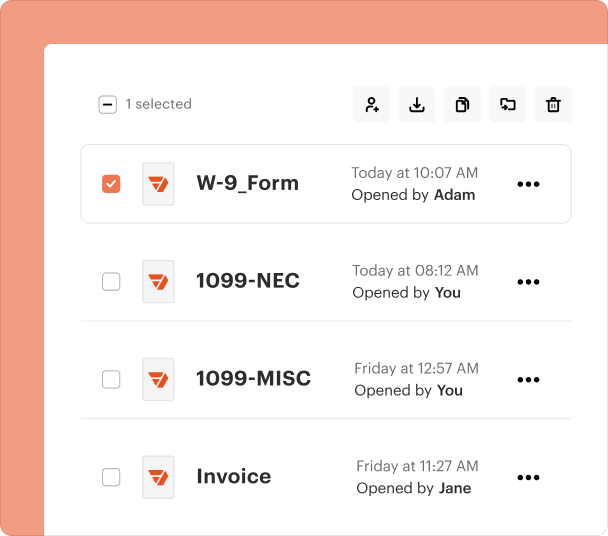

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

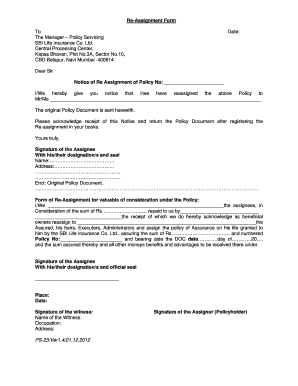

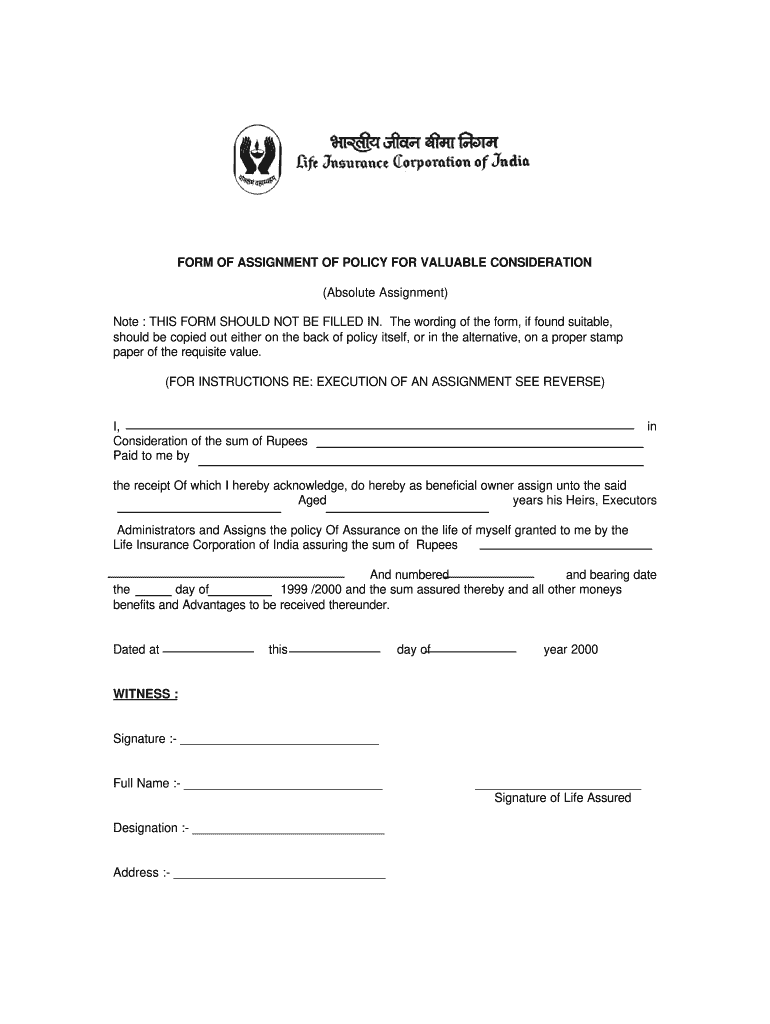

Understanding India Form No. 3848

Overview of India Form No. 3848

India Form No. 3848 is a documentation tool used primarily for tax-related purposes within the Indian financial system. It is essential for taxpayers to accurately report their income and fulfill legal obligations. This form is integral to the compliance process, particularly in managing and communicating financial details to the relevant tax authorities.

Key Features of India Form No. 3848

The main features of India Form No. 3848 include clear sections for personal and financial information, as well as designated areas for declarations and signatures. It has been designed to facilitate straightforward reporting and includes guidance for users on how to fill it out accurately. Its structured format minimizes common errors and helps users ensure their submissions meet regulatory standards.

Instructions for Completing the Form

Filling out India Form No. 3848 requires careful attention to detail. Users must gather all necessary documentation reflecting their income and deductions. Each section of the form must be filled in accordance with the instructions provided, ensuring that personal information is up to date and accurate. It is advisable to review the completed form thoroughly before submission to avoid any potential issues.

Who Should Use India Form No. 3848

This form is primarily intended for individuals and businesses that need to report income or financial transactions to the Indian tax authority. Taxpayers who are self-employed, freelancers, or those with complex income sources may find this form particularly relevant in ensuring compliance with current tax obligations.

Common Mistakes to Avoid

When completing India Form No. 3848, users often overlook important sections or fail to provide supporting documents, which can lead to submission delays or rejections. Other common mistakes include incorrect math calculations or providing outdated contact information. It’s crucial to take the time to double-check all entries and ensure that everything is complete before submitting the form.

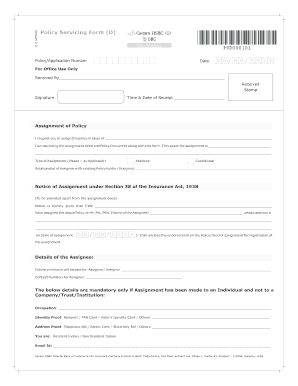

Submission Methods for India Form No. 3848

India Form No. 3848 can typically be submitted online through the official tax authority's portal. However, some individuals may still prefer to send a physical copy through registered mail. Users should verify the preferred submission method with the relevant authorities to ensure compliance with current regulations and guidelines.

Frequently Asked Questions about lic policy assignment form

What is India Form No. 3848 used for?

India Form No. 3848 is used for reporting income and ensuring compliance with tax obligations in India.

Who needs to fill out India Form No. 3848?

Individuals and businesses that report various income sources or financial transactions to the Indian tax authority need to fill out this form.

pdfFiller scores top ratings on review platforms